NFA.01

NFA’s portfolio provides investors with access to a diversified collection of sought-after artworks purchased at primary prices, amplifying returns and de-risking acquisitions by avoiding the secondary market (auction houses).

Highlights

Noyack Fine Art is the first collection uniting artists and investors as owners

NFA is the only investment portfolio that purchases work directly from artists—enabling collectors to invest in artworks that are virtually impossible to obtain

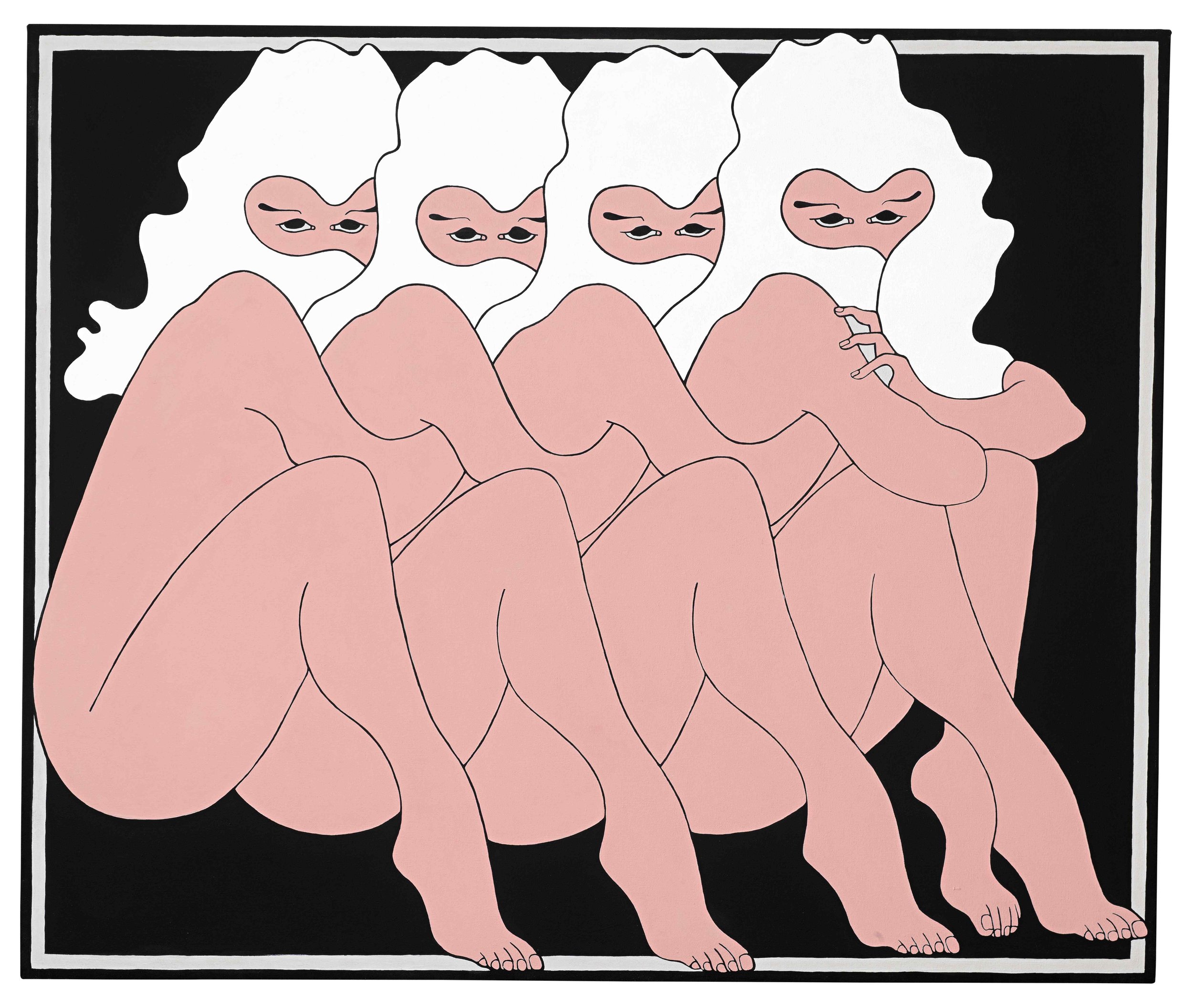

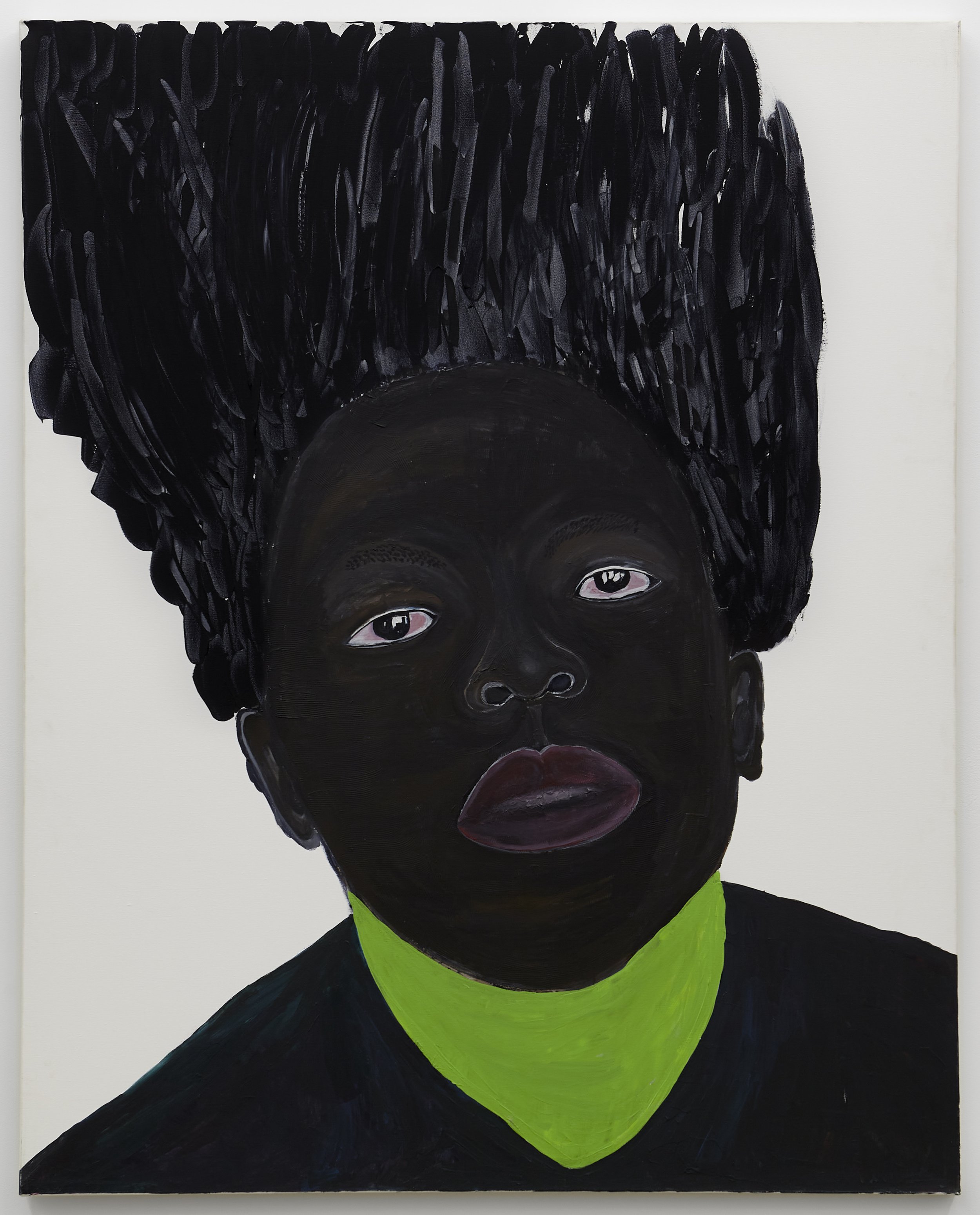

Our portfolio, valued at $3.8 million, features works from blue-chip artists including Charline Von Heyl, Wangechi Mutu, Leonardo Drew, Kara Walker, Toyin Ojih Odutola, and Nicole Eisenman

Our Curation Board selects art made by emerging to world-renowned artists who have demonstrated professional growth in their practice

Contemporary art has outperformed the S&P500 by 3x since 1990, but it’s been difficult for investors to participate—until now

Primary vs. Secondary Market

There are two primary markets for fine art: the primary market and the secondary market.

The primary market is where art is sold for the first time, typically by the artist or their gallery. This means that the prices for the artwork are set by the artist or their representative, and can potentially be more affordable compared to the secondary market. Additionally, art purchased on the primary market is often newer and can have a more significant potential for appreciation in value over time.

The secondary market is where art is resold, usually at auction or through private sales. Artwork sold on the secondary market has already been bought and sold before and may have increased in value over time. However, it's important to note that the prices for artwork on the secondary market are often inflated due to high demand.

Why Purchase on the Primary Market?

Purchasing on the primary market means that the artwork is being sold for the first time, so you can be confident that NFA is getting a fair price for the artwork

Artwork purchased on the primary market has the potential for a higher appreciation in value over time

NFA gives investors access to fine art acquired at a 15–20% discount to retail by purchasing directly from artists

What this means is that every time NFA acquires an artwork, it’s instantly worth more than we paid for it.

Deal Terms

- Net Asset Value $3.8M

- Minimum Investment $250,000

- Price Per Share $20

- Legal Construction LLC

- Management Fee 1.5%

- Risk Category Growth

- Investment Term 3-5 years

- Established 2023

- Target Return 3x MOIC

- Auditors CohnReznik

- Counsel Winston & Strawn

Documents

Portfolio Value

The value of the current portfolio as determined by an independent appraiser is $5 million.

This represents over 400% appreciation since 2017

Management

-

Andrea Pemberton is an accomplished art professional with thirteen years of experience building international private and corporate art collections, producing artist projects, and curating site-specific installations. Her unique perspective on the contemporary art scene has made her a sought-after curator.

Andrea is the CEO and lead curator of NFA.01, a portfolio collection that gives artists an enduring economic stake in the success of their own work. Her innovative approach empowers creators to benefit from the appreciation of their art alongside investors, creating a new paradigm in the art market.

Andrea's career began in 2011 at the prestigious Gagosian Gallery, where she worked alongside Larry Gagosian as an assistant in New York and later as a sales and artist management professional in Los Angeles. She spent six years at the gallery, honing her skills and developing her unique curatorial approach.

After leaving Gagosian, Andrea spent three years as the Director of the digital platform for emerging artists, Tappan Collective. In this role, she led key business and roster development initiatives, helping to elevate the careers of up-and-coming artists.

Now, with NFA.01, Andrea is once again pushing the boundaries of what is possible in the art world. Her collection empowers artists to take control of their own success, creating a more equitable and sustainable art market for all.